Normally I would try to send 4 updates each year. But this year was special…. In January, we backed out of a 150 unit deal after due diligence; in February, a large portfolio deal fell through; in March, a week before closing due to COVID, the bank pulled back a blanket mortgage for a single family portfolio. At the time, I thought the bank did us a favor... Little did I know that single family homes in the suburbs would be the best investment of the pandemic. So, due to the uncertainty and volatility in the US real estate market, I spent most of the year in Israel "avoiding the Corona police" in Apollonia Eco-Park and Herzliya beaches and trying to ignore the refrigerator that stood in my way every time I went for a "walk"…

2020 began as a cursed, barren, year with no transactions and high anxiety. But in August things changed and I bid farewell to the Apollonia fields of Israel. Between September and December, my partners and I managed to sell one property, buy two properties, sign a contract on the third, and get a price offer for the fourth… Squeezing a full year into 3 months! The hunger for normalcy was a motivation, no doubt. During these months I hopped between New York, New Jersey, Georgia, and South Carolina. I'm usually based in Atlanta, but I did spend a long time in Hoboken, which is a 6-minute train ride from NYC. Legally, I was forced to self-quarantine coming to NYC from Atlanta, and I really didn't feel like staying between four walls in Manhattan. So, I stayed in Frank Sinatra's town and learned to appreciate Hoboken. I lived in a neighborhood that resembled Greenwich Village. Many young people, bars and restaurants and they all seemed less stressed than New Yorkers. That is until the management in my building shut down the gym: then they were not as cool as the guys in Georgia…

This year will probably be remembered as an annus-horribilis for most people… But even though it began with a bang and isn't over yet, maybe in a few years when reflecting, I'll be able to say that to me personally, it wasn't so bad. Or as Hoboken's native Frank Sinatra sang with his special voice: “It Was A Very Good Year”. (Great song except that he shifts too fast from age 35 to the Seniors’ Home!) …

In GREI, we've sold Alison Court, a multifamily we bought in South Atlanta in 2016, and we bought Olley's Creek in the attractive town of Marietta, North West of Atlanta. The due diligence took forever because of COVID. Everything became slow and the level of uncertainty and red tape was unbearable. During one moment of despair, when more paperwork and requests were thrown at me from Freddie Mac, I called the seller, that was also in tears, and asked him: "Hang on. We're almost there, don't you bail on me now…". As soon as we received the Commitment Letter, we went to sign, because these days, no one can be sure when the lender may change his mind, or that banks may close, or county or city-halls or courts shut their doors to the public. I've mentioned that earlier this year a mortgage bank pulled out in the last minute: “Once Bitten, Twice Shy”! We didn't wait a moment longer and rushed to close. The best part is that due to the time delay, the property is already valued higher than the purchase price.

In 40-Broad, we've signed a contract to purchase three small multifamily complexes in North Myrtle Beach, SC. The town is a major tourist destination known for its year-round beaches, golf, and Canadians in the winter. This transaction is a pilot for an expansion plan in the area. Lastly, we've entered into negotiations to purchase a mixed-use building in Manhattan.

Alison Ct., Atlanta, GA Olley's Creek, Marietta, GA

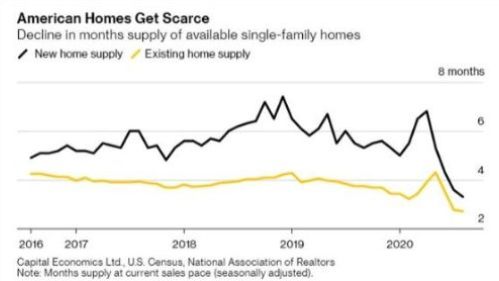

We know that a vaccine is in its late stages for approval and can sense the optimism. There are some expectations in the real estate market for a Coronavirus mirror reaction. Which means that suburban SFH will become less popular and urban real estate will shoot back up. I think this makes sense, but not just yet. First, it will take a while to distribute the vaccine, so we don't know when the state of emergency will end. Masks will stay with us for a while yet. Second, I do not think that all those who rushed to buy Single Homes in the suburbs will sell them now at a loss. Third, construction of new homes in the US was down during the months of the pandemic so there's less stock, and construction cost and materials are now more expensive. Lastly, there are expectations for inflation due to the CARES Act and monetary easing. This will have an upward pressure on nominal prices in general.

Building Cost Index Supply of single-family homes

As for Multifamily, not all territories were impacted the same way. New York City for example, is in a dire state. The city will need a cash injection, probably from the Federal Government. How dire? Here is a photo that I took last week of one of Manhattan's most desirable office locations. You can see the floor, which indicates that the building is empty! Many point fingers at the State and City that acted disproportionally to other Governments. Did less people die proportionally in NYC compared to Atlanta? Here's the answer. NYC is an overcrowded city. It's a valid argument. But so is Downtown Atlanta… Consequently, NYC real estate prices have dropped, which draws many bargain hunters to swoop on distressed properties, and some cash stressed landlords will have to dump their properties.

We may have not reached the bottom in such hard-hit cities. Real estate is a long-term business and there are good arguments to support the notion that the situation may not get better even with the vaccine. Here are some points to consider before you gamble on a swift recovery:

There are nearly twice as many delinquent mortgages as there were in the beginning of the year. Serious delinquency volumes are more than five times their pre-pandemic levels. Foreclosures are forbidden for now but soon the ban will be lifted. Will landlords be able to pay their debts? Many won’t, especially those with high LTV. Private lenders won't wait too long either. The question is how the big banks and institutions will react. Obviously, they will restructure the debt with some, sell notes to a 3rd party with some, and repossess or sell the properties with others. Interestingly, the five states with the highest mortgage delinquency levels (October) are: MS, LA, HI, NY and TX.

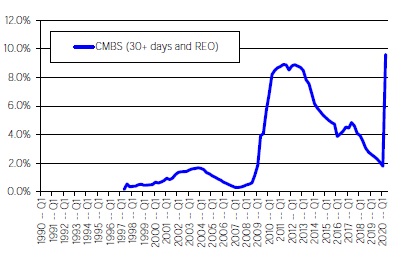

Commercial/Multifamily CMBS Mortgage Delinquency Rates are at a higher level than in the 2008 Crisis. Commercial Mortgage-Backed Securities (CMBS) are fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate. The servicer's fiduciary responsibilities are to its customers, who are the bondholders and the trust, not to the borrower. Short selling or foreclosing on the property may sometimes be in their best interest.

The Centers for Disease Control and Prevention (CDC) has banned evictions in the US during the pandemic. This decision is now being challenged in court but is expected to end anyway on 12/31/2020 unless extended again. If ended, no landlord will allow bad debt tenants to stay. The eviction courts will be overwhelmed, which may prolong the process but eventually those who didn't pay will have to move elsewhere and their credit score will be affected. Rent (or concessions) will drop to a lower market level to enable income from the property. Lower income has a negative impact on the value of the property.

Unemployment rate is back to 6.9%, which is a good sign. But we're back to 2014. Unemployment won't help rents to rise back up.

Real Average Hourly Earnings went down in April 2020 and the rate hasn't recovered yet. This too, will impact rents. It's customary to assume a 2%-3% annual rent increase in residential real estate business plans. For the properties we bought this year, we figured 0% rent increase…

I won't overload you with additional facts but there are definitely serious arguments to support the theory that maybe we're close to the bottom, but we may wade through the mud for a while…

CMBS (30+ Days and REO) USA Real Average Hourly Earnings

Source: © Mortgage Bankers Association Source: © Statista 2020

I expect the end of the state of emergency to affect the economy like a giant shock absorber that slowly reverts to its original position. Office and street traffic will come back. Not at the pre-COVID levels. I guess two years, or maybe more will be needed for a full U-Turn. Retail will not be the same either. Retail was in trouble even before the pandemic. The lockdown has only accelerated the process. However, it's evident that people are eager to go back to their normal life. I also think that city centers are now occupied by young people who never left. The young generation has stayed in crowded cities for social reasons and those that only dreamt in the past of being able to live in small city dwellings are now occupying large apartments with a year lease in hand… Big businesses will come back to city centers looking for its current, educated and inexpensive workforce. If you think otherwise, just check Washington Square and Central Park in the weekends and see them by the thousands, and understand that no virus will scare the Millennials or Generation Z (or whatever new buzzword name they give them now) from crowded cities. On the contrary, the situation was kind to them in this respect.

And lastly, liquidity and more specifically, low interest rates will probably stay with us for a long time yet. Out of all the arguments I've mentioned, this one almost by itself, has the most influence on real estate prices. We'll discuss this some other time.

30 Year Fixed Rate Mortgage Average in the USA

I wish you all Happy Hanukkah, Merry Christmas, Novy God, and most importantly, a Happy New Year!

This publication is personal and not for general circulation. It does not form part of any offer or recommendation. It does not take into consideration investment objectives, financial situation or needs of any specific person. Prior to committing to an investment, please seek advice from a licensed professional regarding the suitability of the product for you and read the relevant product offer documents, including the risk disclosures, If you do not wish to seek financial advice, please consider carefully whether the product is suitable for you.

header.all-comments